Expansion of the Healthcare Sector

The expansion of the healthcare sector significantly impacts the Air Separation Plants Industry. With an increasing number of hospitals and healthcare facilities, the demand for medical gases such as oxygen and nitrogen is on the rise. These gases are essential for various medical applications, including anesthesia and respiratory therapies. As healthcare infrastructure develops globally, the need for reliable air separation plants becomes critical. This trend is expected to bolster the Air Separation Unit Market, as healthcare providers seek efficient solutions to meet their gas supply needs, thereby contributing to the overall market valuation.

Increasing Demand for Industrial Gases

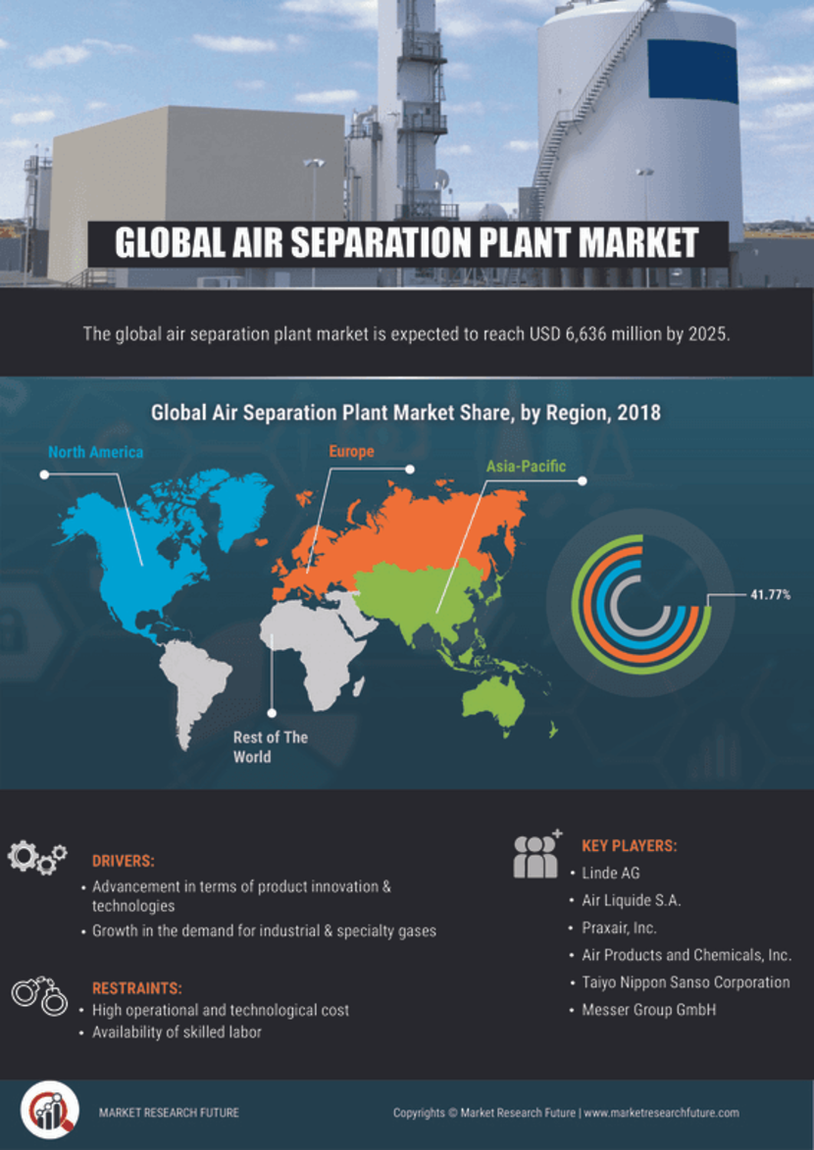

The Air Separation Plants Market is witnessing a surge in demand for industrial gases, driven by various sectors such as healthcare, food and beverage, and manufacturing. The need for oxygen, nitrogen, and argon is escalating, particularly in medical applications where oxygen is critical for patient care. In 2024, the market is valued at approximately 6.01 USD Billion, reflecting the growing reliance on these gases. As industries expand and modernize, the requirement for efficient air separation technologies becomes paramount, indicating a robust growth trajectory for the industry.

Technological Advancements in Air Separation

Technological innovations are playing a pivotal role in shaping the Air Separation Plants Industry. The introduction of advanced cryogenic processes and membrane technologies enhances the efficiency and cost-effectiveness of air separation. These advancements not only improve production rates but also reduce energy consumption, aligning with global sustainability goals. As a result, companies are increasingly investing in state-of-the-art air separation plants to optimize their operations. This trend is expected to contribute to the market's growth, with projections indicating a market value of 9 USD Billion by 2035, driven by the adoption of these cutting-edge technologies.

Growing Focus on Environmental Sustainability

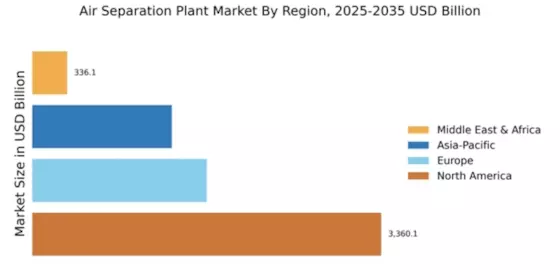

The Global Air Separation Plants Industry is increasingly influenced by the global emphasis on environmental sustainability. Companies are under pressure to reduce their carbon footprints and enhance energy efficiency. Air separation plant Market that utilize renewable energy sources and implement carbon capture technologies are gaining traction. This shift not only meets regulatory requirements but also appeals to environmentally conscious consumers. As industries strive to align with sustainability goals, the demand for eco-friendly air separation solutions is likely to rise, further propelling market growth. The anticipated CAGR of 3.74% from 2025 to 2035 underscores this trend.

Rising Industrialization in Emerging Economies

Emerging economies are experiencing rapid industrialization, which is a key driver for the Air Separation Plants Market. Countries such as India and Brazil are witnessing significant growth in manufacturing and chemical industries, leading to an increased demand for industrial gases. This industrial expansion necessitates the establishment of air separation plants to ensure a steady supply of essential gases. As these economies continue to develop, the market is poised for growth, with projections suggesting a robust increase in demand for air separation technologies to support industrial activities.